Features

Overview

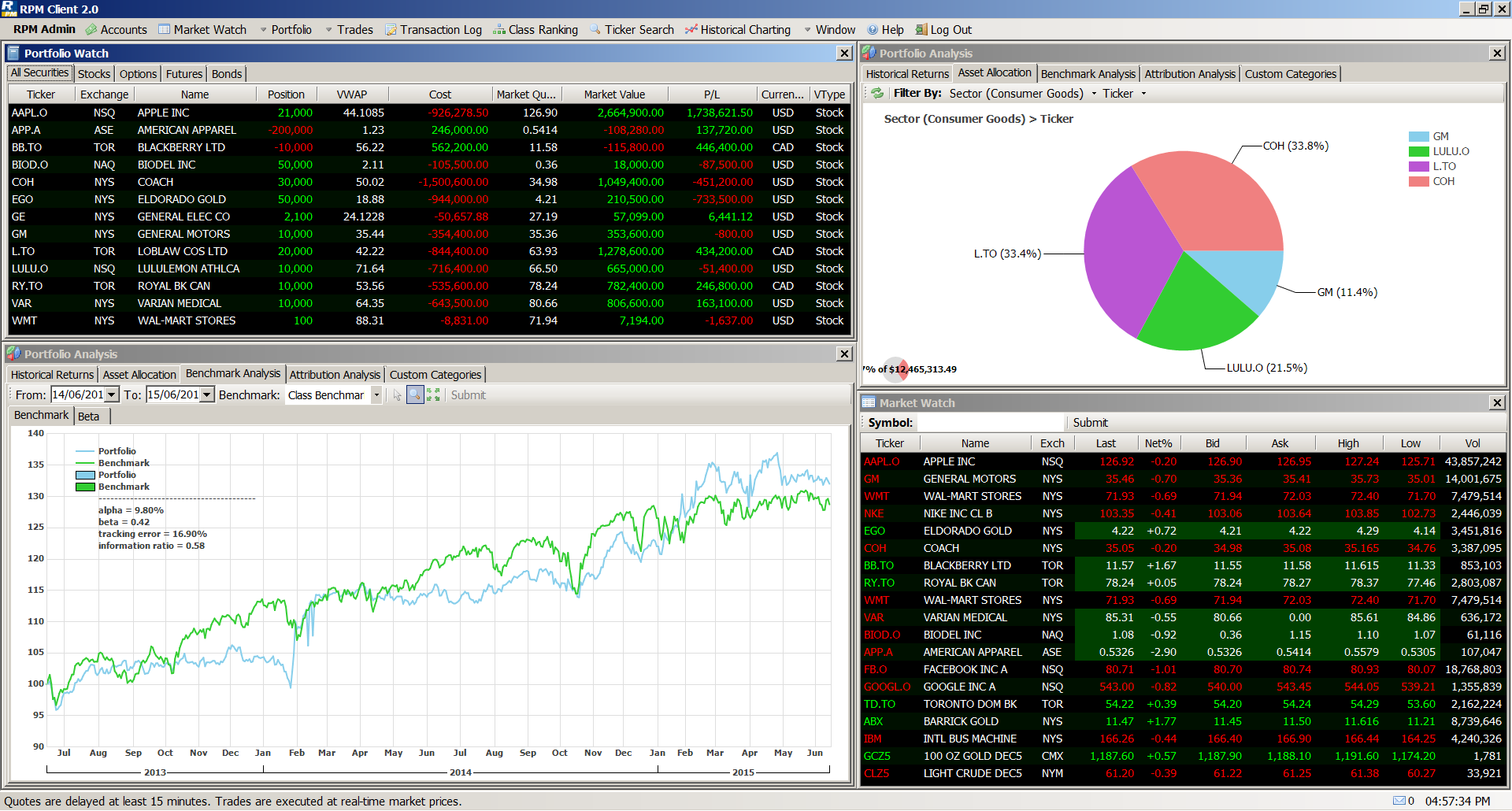

RPM offers students advanced trading and portfolio management features that allow them to focus their time on the portfolio design and management process. The features have been designed to be as realistic as possible, while remaining easy to learn and conducive to the classroom environment.

Trading Interface

The trading interface is customizable and modular allowing for maximum flexibility for students using the application. Students can select whichever trading and portfolio analytics modules they wish to display, as well as what fields of data, filter level, and/or period length to view.

RPM provides a robust all-in-one solution to allow students to get the most from the simulation experience.

Trading

Advanced Order Types

Students can input trades with the Market, Limit, Stop-Loss, or Market-On-Close order type flag.

Order Control

Trades can be flagged in OCO (One-Cancels-Others) sets that allow for robust portfolio weight manangement or trading brackets.

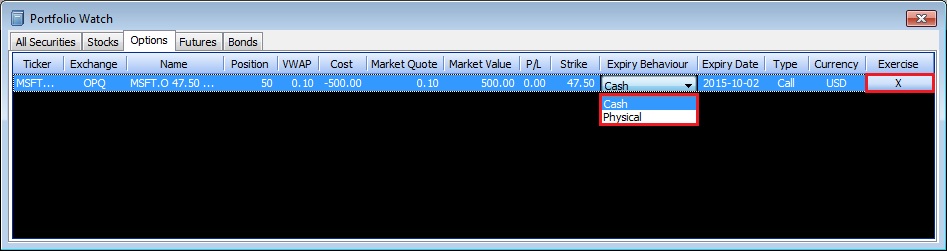

Expiration and Settlement of Options

Options can be early exercised (although this is rarely optimal), set to exercise on expiration, or cash-settled on expiration.

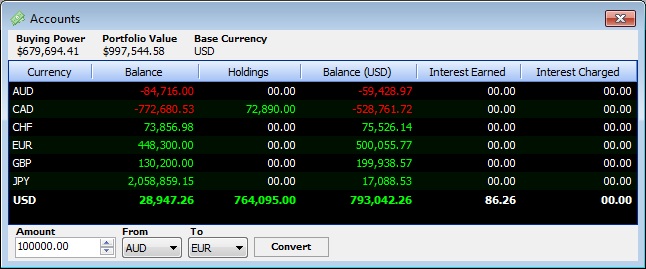

Forex Management

Students are able to manage their foreign exchange financing and exposure by adjusting their cash balances denominated in different currencies. Currency financing rates are specified by the professor and can be based on LIBOR, LIBOR with a specfied spread, or fixed values.

Portfolio Management

Returns and Sharpe Ratio

RPM automatically calculates and plots daily portfolio values and Sharpe ratios. The data can be viewed and exported in either a tabular (Excel) format or in chart form.

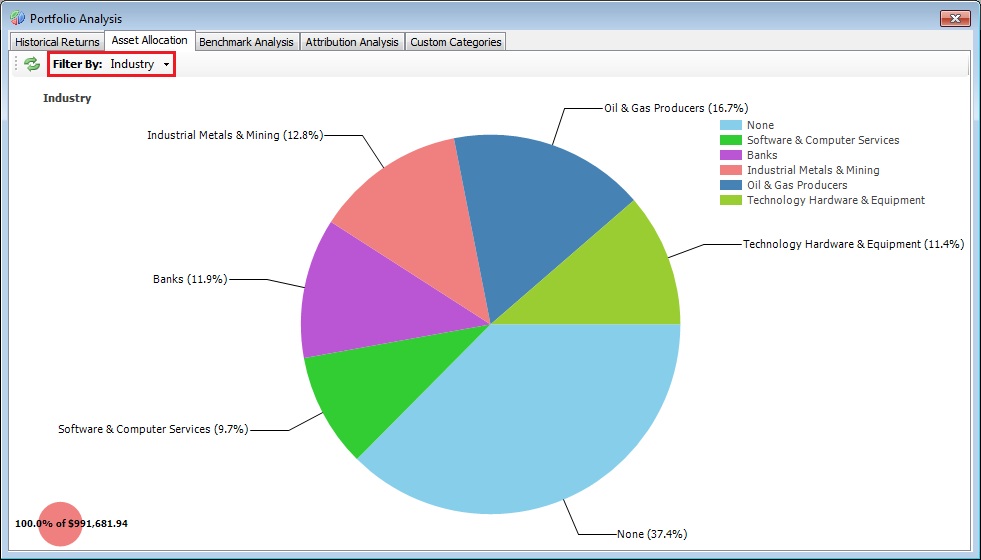

Asset Allocation

Students have immediate real-time access to their portfolio’s asset mix that can be further filtered down by Asset Class, Sector, Industry, Country, or Security. This powerful asset allocation analysis tool can also sub filter the asset mix through multiple “drill down” levels.

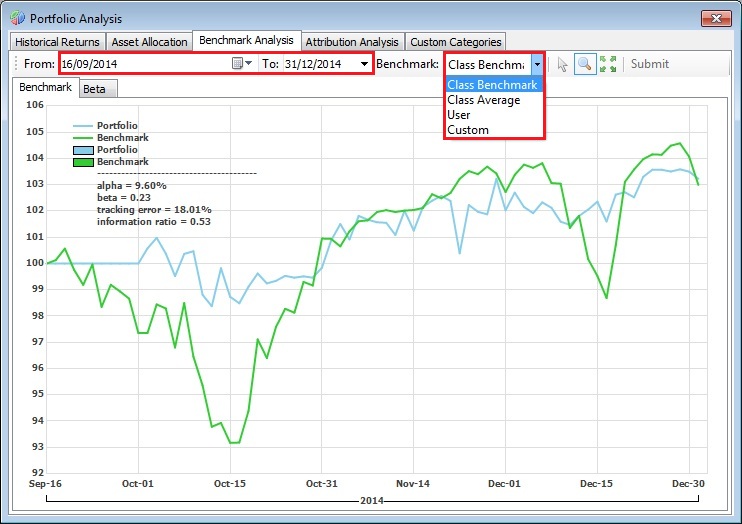

Benchmarking

Account performance can be benchmarked against a professor (class) specified benchmark, the class average performance, or custom user-specified benchmarks. The benchmarking function shows the students performance, tracking error, information ratio, alpha and beta versus the selected benchmark.

Attribution Analysis

Similar to the asset allocation feature, students can identify how different assets, asset classes, industries, or individual securities contributed to the overall portfolio returns. These returns can be further sub-divided through the standard Rotman Portfolio Manager “drill-down” approach.

Tutorials for Students

Please check out the following two guide documents as well as the tutorial video.

Quick Start Tutorial - Creating and registering your RPM accounts

Full tutorial video for students

How to Get Started

Step One – Download the Rotman Portfolio Manager application

Please visit the Download page to download and install the Rotman Portfolio Manager on your computer.

Step Two – set up your RPM account

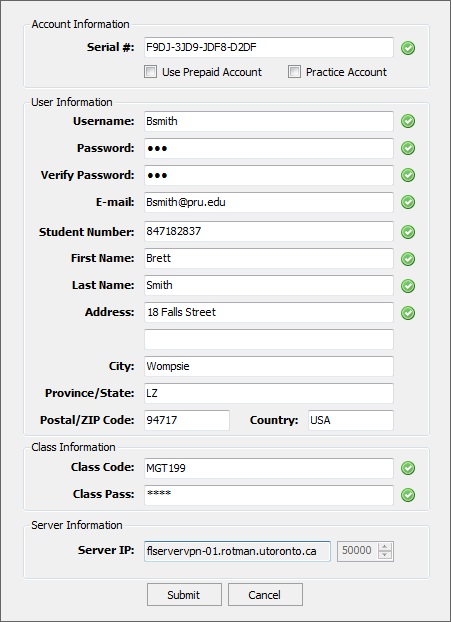

First, get your class code and class password from your professor (usually written on the RPM Quick Start Guide) . You cannot create an account without one.

Then, visit the Rotman Portfolio Manager Purchase website and purchase an account serial key. A serial key will enable you to create an RPM account and join your professor’s class. Each account is active for 14 weeks (one semester) from the day it is created. Note: Some professors/schools may choose to pre-pay for the accounts. If this is the case, click the “Prepaid Account” button and leave the serial key area blank, as you do not need to purchase a serial key from the Purchase website.

Step Three – watch our tutorial video to start managing your portfolio!

Want to create your own practice account?Practice accounts are available for $20.00 CAD per account. Practice accounts cannot join the class and are meant only for students to use if they want to manage their own accounts outside of the class.

Professors cannot view or administer practice accounts. You must still use a valid class code and password when registering for a practice account, even though your account will not be part of the class. Once you create your practice account, it will be registered under our practice class.

Copyright © 2015 Rotman School of Management | 105 St.George Street, Toronto, ON.